how much is inheritance tax in nc

Some states also issue an inheritance tax to the beneficiary so you would be liable for this charge in addition to the estate tax. There is no inheritance tax in NC.

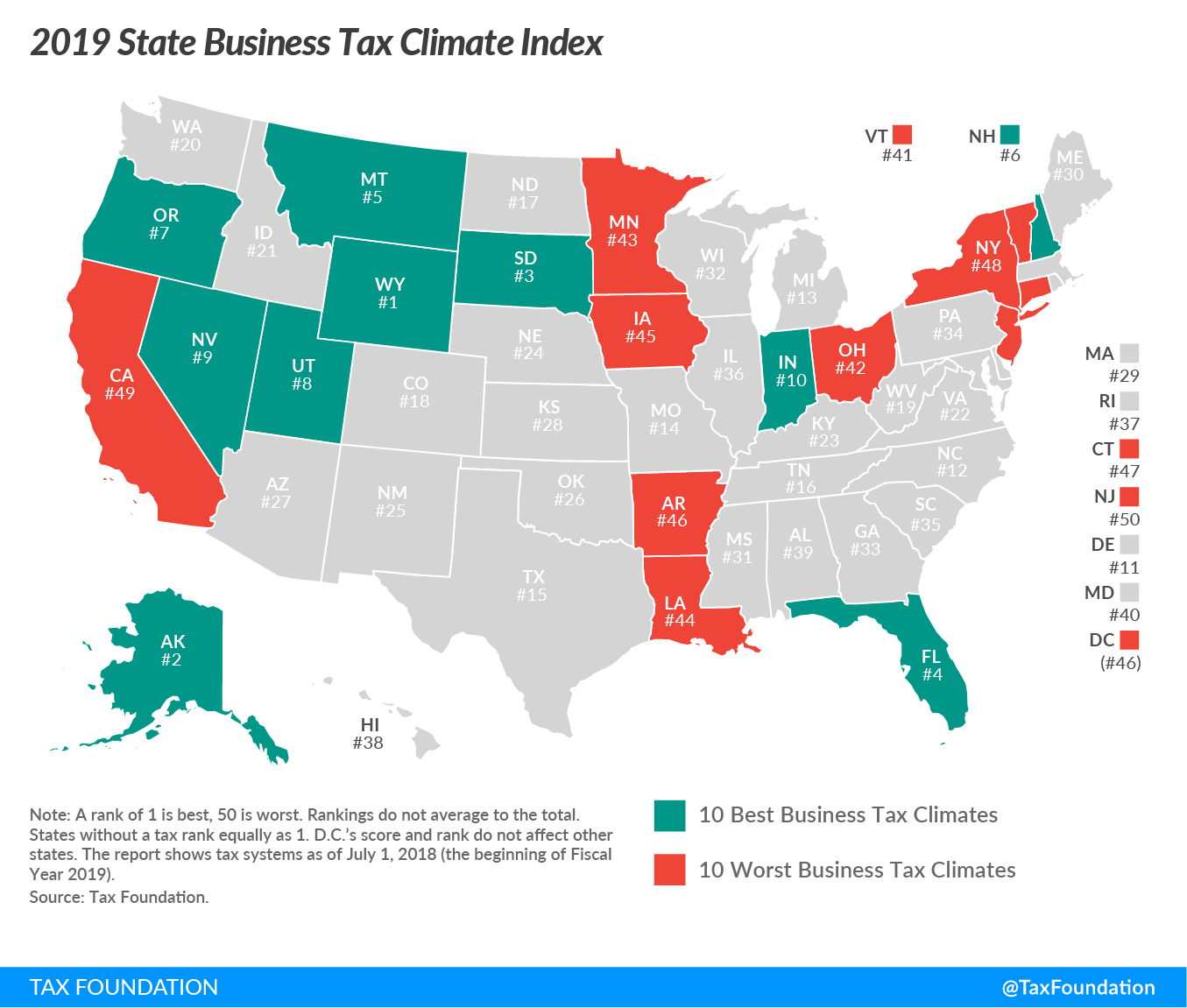

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

4141 Parklake Avenue Suite 130 Raleigh.

. Still another reason to set up this kind of a trust is to safeguard the inheritance your children will receive. State inheritance tax rates in 2021 2022. Avoiding Capital Gains Tax.

Fortunately when you inherit real estate the propertys tax basis is stepped up which means the value is re-adjusted to its current market value and often reduces or entirely eliminates the capital gains tax owed by the beneficiaryFor example Sallys parents purchased a house years ago for 100000 and bequeathed the property to Sally. Income Tax Return for Estates and Trusts each year that the trust has 600 in income or has a non-resident alien as a beneficiary. Get trusted advice on investing retirement taxes saving real estate cars college insurance.

State Inheritance tax rate. Leader in personal finance news and business forecasting. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

No Inheritance Tax in NC. All property taxes mortgages HOA fees or liens for the property are owed as well. What Happens When a Person Dies Without a Will Under North Carolina Inheritance Law.

Request A Call Back. Brady Cobin Law Group PLLC. If your children lack financial savvy setting up a managed irrevocable trust is a way to provide for them in a more controlled way than simply giving them a lump-sum gift.

Trusts must file a Form 1041 US. This type of trust can. Prior obligations are transferred to you and future fees will accrue over time.

Set up an irrevocable trust to protect your childrens inheritance. Depending on the amount of debt. If you dont have health insurance coverage you wont have to pay a penalty when you file your federal taxes though a handful of states have passed their own insurance requirements with penalties.

No matter where you live think. These are some of the taxes you may have to think about as an heir. However there are sometimes taxes for other reasons.

Visit Our Offices in Raleigh Wake Forest Cary. You wont face a federal tax penalty for going without health insurance in 2022but there are many other downsides to being uninsured. Call Us Now For Help 919 782-3500.

How much is inheritance tax. Usually there are no income taxes associated with the transfer. There is no federal inheritance tax and only six states have a state-level inheritance tax.

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

Historical North Carolina Tax Policy Information Ballotpedia

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

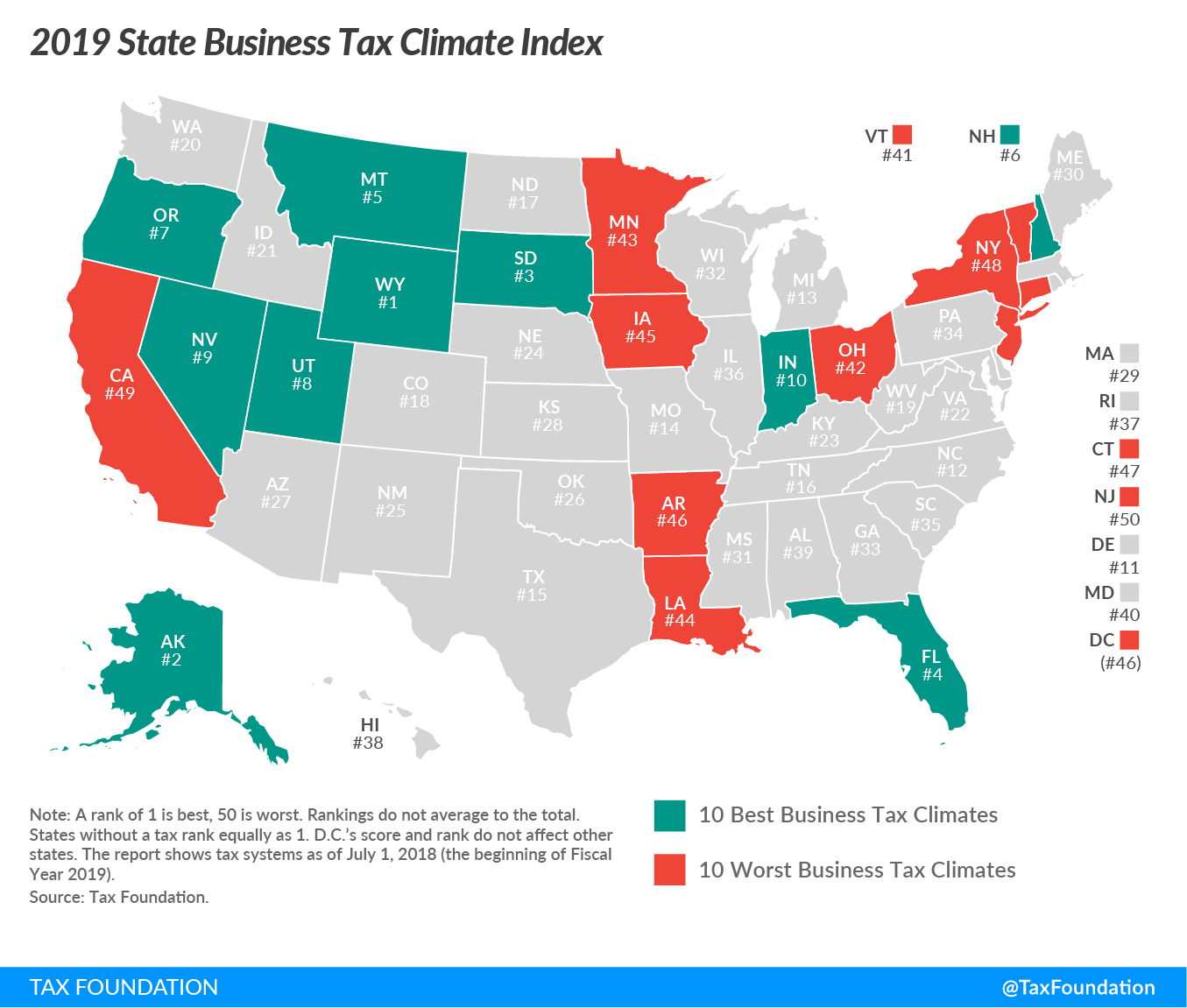

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

States With No Estate Tax Or Inheritance Tax Plan Where You Die