are delinquent property taxes public record

Learn how you can pay your property taxes. Typically a tax lien is placed on the property by the government when the owner fails to pay the property taxes.

Secured Property Taxes Treasurer Tax Collector

Important Information Dates.

. Delinquent Property Tax Search. Titles Deeds Liens Building Permits Parcel Maps. The Clerks office also provides calculations of.

Delinquent Real Estate Taxes. For information on taxes or sewer billings please contact the Tax Collection Office at 732 562-2331. The Tax Office accepts full and partial payment of property taxes online.

Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for. Assessor Records and Delinquent Taxes Henrico County Real Estate Division 4301 East Parham Road Henrico VA 23228 Phone 804501-4300 Interactive Voice Response IVR system. To View ALL Notices CLICK the Search RE Button.

View information about Albany County real property auctions and county-owned property sales including list of properties. If a certificate of delinquency is sold to a third party purchaser the. For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000.

The funds can also be applied to eligible court costs abstract fees and other suit-related fees. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. The Delinquent Tax Division investigates and collects delinquent real and personal property taxes penalties and levy costs.

A 3 minimum mandatory charge and advertising charge is imposed on April 1. Property taxpayers may use credit cards debit cards or e-Checks to pay their taxes. Ad Find property ownership and title history look into sale prices mortgages foreclosures.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. All payments received may not be shown as of this date. Interest accrues at a rate of 15 per month plus advertising and fees.

Once a property tax bill is deemed delinquent after March 15 of each year the debt goes into execution and the County Treasurer sends the. Contact for View the Public Disclosure Tax Delinquents List. Household income at or below 100 Area Median Income or 100 of the median income for the US whichever is greater.

The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. All taxable real and personal property with the exception of public utility property is assessed on the local level at the county courthouse with the county assessing official. The Tax Collectors office is responsible for collecting taxes for the Township of Piscataway Middlesex County the Piscataway School Board and the Piscataway fire districts.

The lien date for taxes is October 1 and taxes are due the following October 1. Evidence of delinquency delinquent tax statement notice from tax attorney. The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor.

Property tax mortgage property insurance HOAcondo fees. Delinquent Taxes and Tax Foreclosure Auctions. If the taxes remain unpaid the taxing unit will foreclose the tax liens and sell the property subject to the liens in satisfaction of its.

If left unpaid the liens are sold at auctions to the public. View the tax delinquents list online. The amount due on each parcel includes costs associated with the sale interest prorated advertising as well as taxes and non-ad valorem assessments.

In addition this department collects annual sewer fees. The specifics about each countys sale along with a listing of each certificate of delinquency are required to be advertised in the local newspaper at least 30 days prior to the tax sale date. 9 am4 pm Monday through Friday.

And maintains an accurate up-to-date account of monies collected. In each of the examples above the county could initiate foreclosure against the real property in question after the taxes become delinquent on January 6. Tangible Personal Property Taxes.

The certificates of delinquency are also listed on the county clerks website at least 30 days prior to the sale. The real estate that is subject to the lien is listed in the name of the record owner as of the date the taxes became delinquent and the principle amount of the taxes is set out in the advertisement below. 2 days agoHomeowners can apply for up to 25000 that can cover delinquent property taxes and mortgage payments.

Delinquent tax records are handled differently by state. 112 State Street Room 800 Albany NY 12207. Eventually the lien owners may have to force foreclosure on the property to pay the liens.

If payment is not received at the Tax Collectors office before June 1st a lien will be placed against the property and additional charges shall be due. Finds and notifies taxpayers of taxes owed. Search Henrico County property tax and assessment records including residential and commercial sales search by parcel id or street address.

Remember that regardless of record ownership delinquent taxes on real property may always be collected through foreclosure on the real property itself. When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property. Learn more about delinquent payment plans and how to apply.

Residential - Commercial - Land. Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Late on one or more payments. An additional 30 fee will be added to all real property bills and an additional 40 fee will be added to all mobile home bills if the taxes penalties and assessment fees are not paid by. Once a property tax bill is deemed delinquent after March 16th of each year a 15 past due penalty is added to the bill and the bill is sent to the Delinquent Tax Office.

At that point you could take possession of. Tax Department Call DOR Contact Tax Department at 617 887-6367.

Tax Certificate And Tax Deed Sales Pinellas County Tax

Notice Of Delinquency Los Angeles County Property Tax Portal

Adjusted Supplemental Property Tax Bill Los Angeles County Property Tax Portal

Substitute Secured Property Tax Bill Los Angeles County Property Tax Portal

Understanding Your Property Tax Bill Clackamas County

Delinquent Property Tax Department Of Revenue

Property Tax City Of Commerce City Co

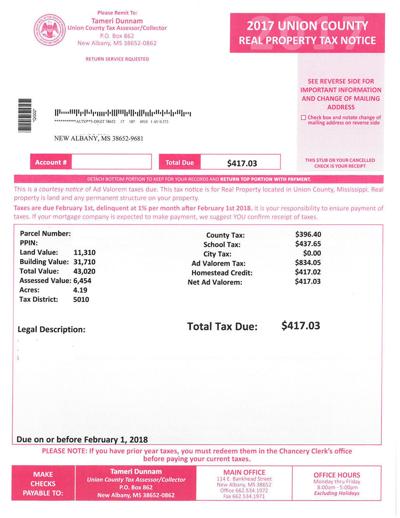

County Property Tax Bills Going Out In The Mail Soon New Albany Djournal Com

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Welcome To Montgomery County Texas

Understanding California S Property Taxes

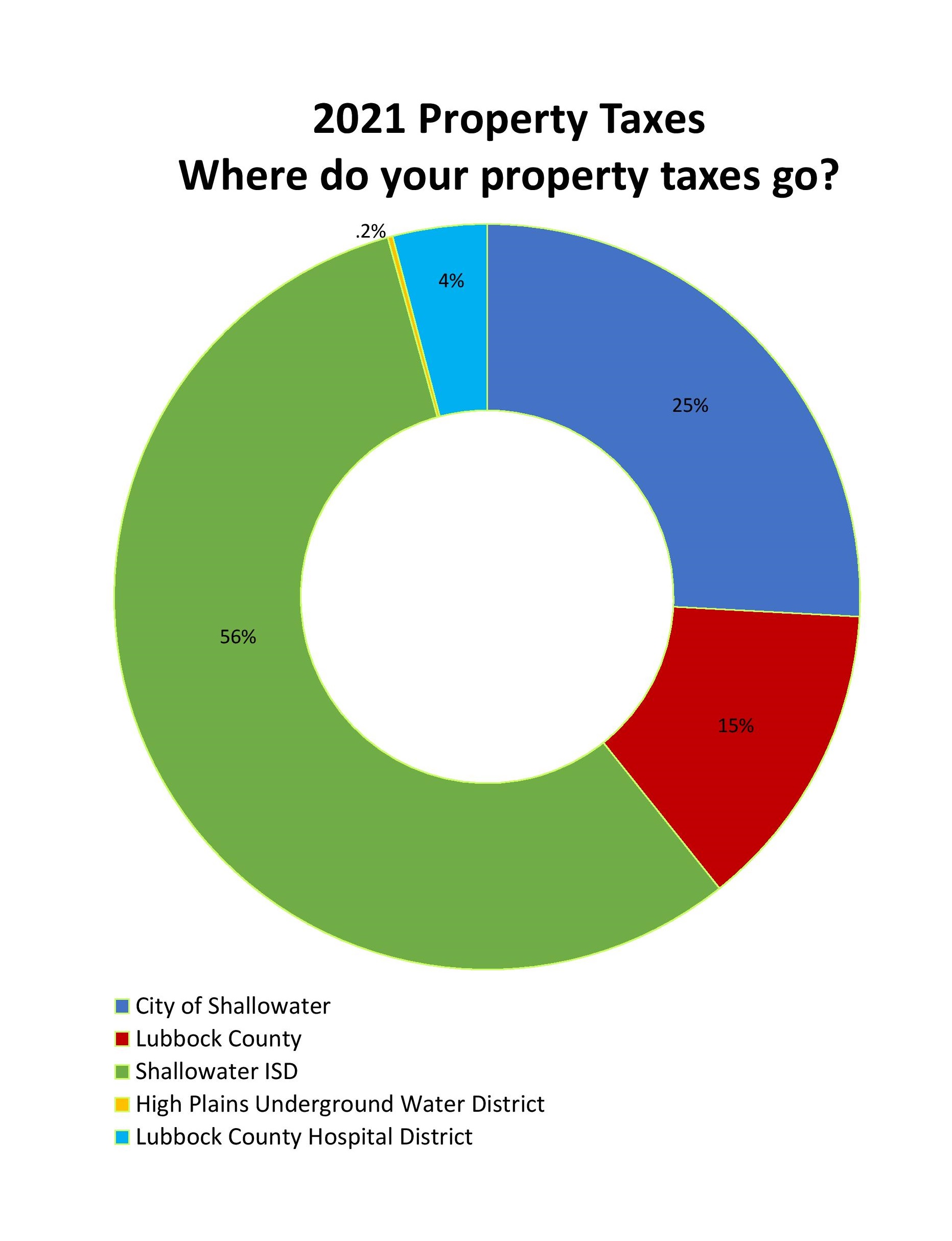

Property Taxes Shallowater Texas

Secured Property Taxes Treasurer Tax Collector

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Annual Secured Property Tax Information Statement Los Angeles County Property Tax Portal

How To Find Tax Delinquent Properties In Your Area Rethority