federal income tax return

Social security number SSN or Individual Taxpayer. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

2018 Irs Federal Income Tax Brackets Breakdown Example Single My Money Blog

It shows how much money you earned in a tax year and how.

. Your household income location filing status and number of personal. The Tax Returns required to be prepared and filed by Otis under this Section 404 shall include a any Xxxx. If you cant file your federal income tax return by the due date you may be able to get a six-month extension from the Internal Revenue Service IRS.

Your bracket depends on your taxable income and filing status. This does not grant you. The Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs offer free basic tax return preparation to qualified individuals.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Individual Income Tax Return. Using the IRS Wheres My Refund tool.

100 Free Tax Filing. Effective tax rate 172. Examples of Xxxx Federal Consolidated Income Tax Return in a sentence.

Follow these steps for tracking your 2021 federal income tax refund. Please ensure that support for session cookies is enabled in your browser. In order to use this application your browser must be configured to accept session cookies.

There are seven federal tax brackets for the 2022 tax year. Already millions of taxpayers have been waiting four or five months for their federal income tax refunds after completing 1040 paper. 2021 tax preparation software.

These are the rates for. A federal tax return is a tax return you send to the IRS each year through Form 1040 US. Viewing your IRS account.

Efile your tax return directly to the IRS. Our income tax calculator calculates your federal state and local taxes based on several key inputs. 10 12 22 24 32 35 and 37.

Form 1040 1040-SR or 1040-NR line 3a Qualified dividends -- 06-APR-2021. Low Income Taxpayer Clinics. June 22 2022 202 PM 10 min read.

Prepare federal and state income taxes online. Face masks and other personal protective equipment to prevent the spread of COVID-19 are tax deductible. Gather the following information and have it handy.

How To File A Zero Income Tax Return 11 Steps With Pictures

Vintage 1961 Federal Income Tax Forms Course Instructions 3 Books Lot Ebay

Ugh What You Need To Know About Filing Your 2021 Tax Return With The Dysfunctional Irs

Solved According To The Irs Individuals Filing Federal Chegg Com

Filing Your Taxes This Year Is Key To Getting The Most Covid Relief Cnn

Due Date Approaches For 2018 Federal Income Tax Returns Coastal Wealth Management

Vector Illustration Of Deadline For Federal Income Tax Returns 1040 Form In The Usa Irs Stock Vector Adobe Stock

Where Is My Tax Refund How To Check The Status After Filing Your Return Pittsburgh Post Gazette

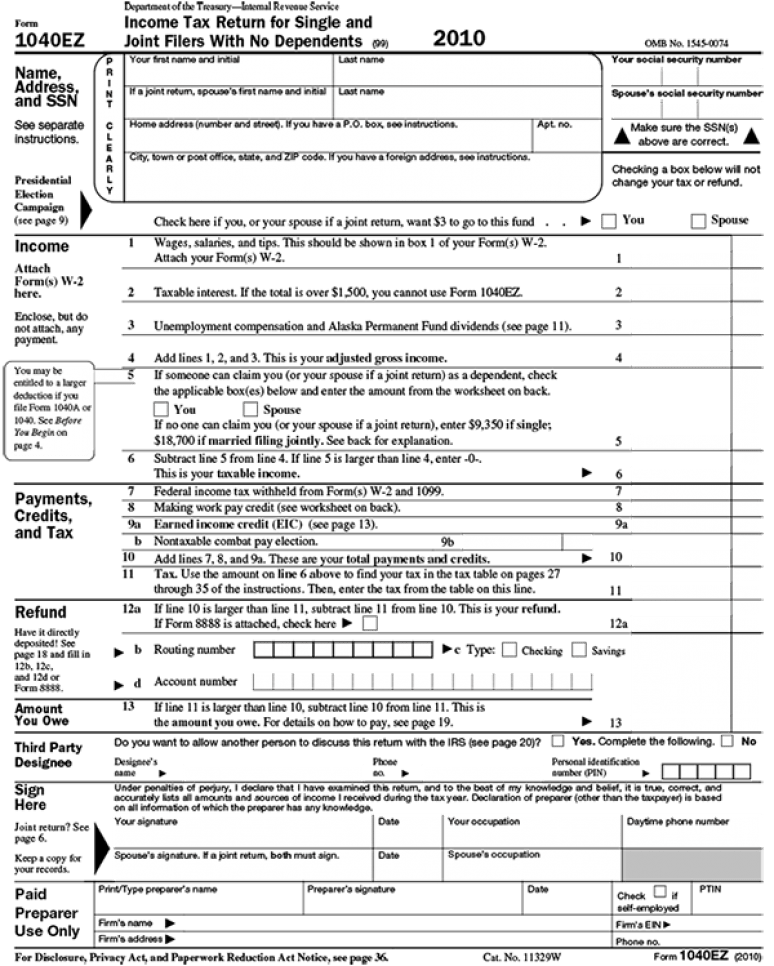

Please Complete The 2019 Federal Individual Income Chegg Com

America S First Income Tax Form Tax Foundation

Solved According To The Irs Individuals Filing Federal Income Tax Returns Course Hero

Solved According To The Irs Individuals Filing Federal Chegg Com

What Is A W 2 Form Turbotax Tax Tips Videos

When Will I Get My Federal Income Tax Refund Wise Finish

When Can You File Taxes Where Is My Tax Refund Check Money

Key Changes To Keep In Mind While Filing Your 2019 Taxes Komo

Tax Forms Tax Information And Local Senior Citizen Tax Preparation

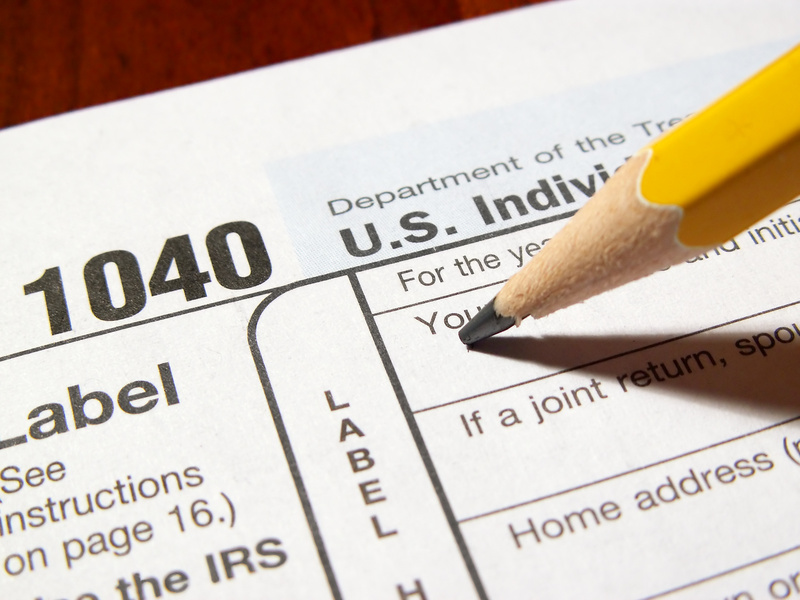

Reproducible Copies Of Federal Tax Forms And Instructions 2010 U S Government Bookstore